What are microservices and why are some organizations deploying microservices 12x faster and 92% less expensive than their peers?

Why microservice-based APIs fast-track the digital transformation of your business

Innovation and modernization is no longer just a way to beat out the competition and stand out in the eyes of the consumers. It’s become a necessity, and companies that cannot keep up with the technology and upgrade their services are destined to fail.

Nearly 70% of businesses worldwide have either begun their digital transformation or have a digital transformation strategy in place and are preparing to execute it. It’s become evident that technological advancements are dictating the pace for modern businesses. The question today isn’t whether innovation is necessary, but rather how fast the businesses can adapt to the ever-changing digital environment and implement these innovations.

Most businesses recognize the need to go digital and provide their customers with an easier, faster, and more convenient way to access their products and services. Although companies have increasingly complex IT systems, they need even faster and better ways to integrate these varied and disparate systems and technologies and embrace innovations. Many still struggle to do so.

Most businesses recognize the need to go digital and provide their customers with an easier, faster, and more convenient way to access their products and services. Although companies have increasingly complex IT systems, they need even faster and better ways to integrate these varied and disparate systems and technologies and embrace innovations. Many still struggle to do so.

Digital transformation poses many challenges, and there are quite a few hurdles companies must jump over in order to ensure that their digitalization is successful. Arguably the biggest challenge of them all is migrating the existing core business architecture to a digital environment.

We've written an immensely popular free book on this topic called "Accelerating the Digital Journey from Legacy Systems to Modern Microservices" which can be downloaded from our website.

What does legacy really mean?

The term legacy is often used to describe outdated hardware and computing software that is still in use. It may also refer to applications, processes, technologies, and even programming languages that companies rely on despite the fact that upgraded versions and fresh alternatives with higher functionality are available.

What’s important to understand is that “legacy” doesn’t mean decades-old technology. Today, it can refer to any technology, database, application, or system that isn’t based on open standards and isn’t compatible with the demands of today’s digital world.

That said, core (legacy) systems are still critically important to organizations and are often the backbone of their business operations. They are often foundational to the enterprise — and the older, more established enterprises especially. Where does this dichotomy come from?

Legacy systems aren’t faulty in any way. They still provide the functionality and meet the business needs they were originally designed for. The problem is — that’s all legacy systems will ever be able to do. They’re built using outdated technology, they cannot leverage the latest digital capabilities such as cloud computing, and cannot interact with newer systems.

In other words, legacy systems are holding companies back and hindering their digital transformation by leaving them unable to take advantage of the latest technological innovations. At the same time, they are essential for the majority of an organization’s business functions, making them extremely difficult to replace.

What’s the solution?

Having to rely on legacy systems makes thousands of companies stuck between a rock and a hard place. They are aware of the need to keep up with technological advancements, while they’re simultaneously dependent on legacy systems and cannot afford to spend the time and resources necessary to create a whole new business architecture.

You cannot forgo your legacy system, but cannot afford to migrate to newer technologies and build an entirely new system from scratch. The question is — what can you do?

OpenLegacy offers you an opportunity to leverage your IT legacy systems to create and deploy microservice-based APIs lightning-fast. Microservices enable you to implement innovations and deliver advanced services to your clients in days, without having to make any changes to your existing system.

We’ve written a comprehensive whitepaper called “Legacy Technology Got You Down? Try Microservices and Cloud-Native Architecture” that thoroughly explains why microservices are the optimal solution for modernizing your legacy systems, which you can download from our website.

What are microservices, and why are they important?

Although it’s challenging to provide a clear-cut, uniform microservices definition, we’ll give you a detailed, step-by-step explanation of basic microservice concepts. Our goal is to answer the question of “what are microservices?” and show you what impact they can have on your business.

At their core, microservices are small, self-sufficient pieces of code that execute a specific business function. Microservices represent a modular architectural approach to application development, where each microservice relies on its own processes to execute a specific function and can be deployed independently.

Monolithic vs. microservice architecture

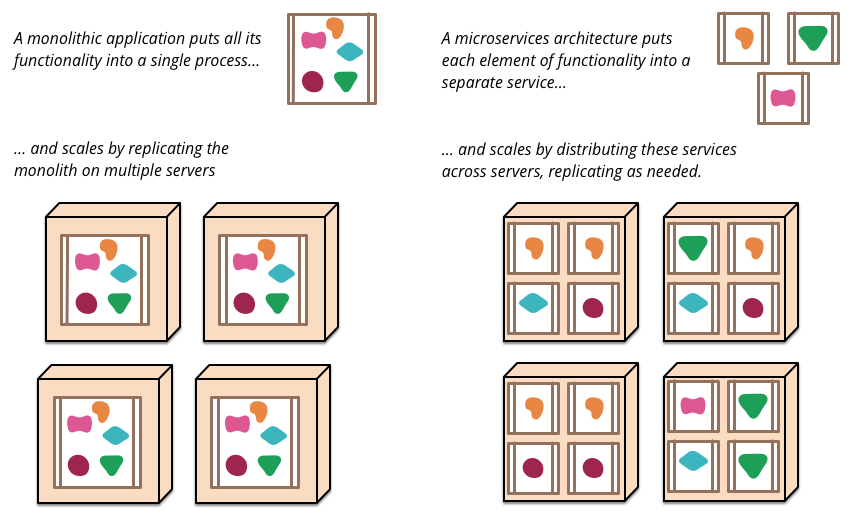

Figure 1: Monoliths and microservices; Image source: Martin Fowler

As an architectural style or framework, microservices are loosely coupled, and they enable development teams to build applications as suites of services.

Since each microservice is deployed independently and is self-contained, developers don’t have to worry about how changes in one microservice will impact the microservice-based application as a whole. Instead, they can focus on building individual microservice for specific functions and can even rely on different programming languages and storage techniques for different microservices.

The main characteristics of microservices architecture

Given the fact that microservices are small pieces of code that perform a single function, there is no standardized model to represent them in every system based on microservice architecture. How they are developed and deployed largely depends on the roles they will perform within the application.

That said, all microservices have several distinct characteristics, regardless of their functionality. The primary characteristics of microservices are:

- Modular approach based on multiple components

- Simple routing

- Failure resistance

- Orientation towards business priorities

- Decentralization

Modular approach based on multiple components

Building software using microservice-based architecture allows you to break down the application as a whole into multiple component services. This modular approach enables teams to deploy, change, and redeploy individual microservices without compromising the integrity of the software.

This allows you to upgrade, change, or even remove services and add new ones to meet the ever-changing client needs or integrate new technologies without having to redeploy the entire application.

Simple routing

Unlike ESBs (Enterprise Service Buses) that rely on sophisticated systems for message routing and applying business rules, microservices receive calls, process them, and generate responses accordingly. Microservices rely on the concept known as “smart endpoints, dumb pipes.”

You can picture microservices as mini-programs, with all the smarts you can cram into them. To integrate microservices, however, you can utilize HTTP-based RESTful interactions or lightweight, open-source queuing technology. In other words, microservices rely on smart endpoints to process the information and apply logic, while the information flows through “dumb pipes.”

Failure resistance

Upon receiving function calls, multiple microservices work together to generate a response and answer the client’s request. Since various microservices are communicating together, when one service fails, the neighboring services can continue to function without any issues. This means that, rather than crashing the entire application, only the service that failed will be unavailable. The software can continue to provide other services while your developers work on fixing the issue.

Orientation towards business priorities

In traditional, monolithic systems, different teams were assigned different tasks and had a specific focus. One team would work on UI, another on databases, the third one on server-side logic, etc. This isn’t the case with microservices. Quite the contrary — ideally, a microservice architecture utilizes cross-functioning teams since each microservice is deployed independently.

This enables you to plan out the development process around business capabilities and prioritize different features and functions as project requirements change.

Decentralization of microservices based architecture

As we’ve mentioned, microservices can rely on various programming languages and a variety of different technologies and may exist on different servers and clouds. Centralized governance typical of monolithic architectures isn’t the optimal approach in the context of microservices.

Developers in the microservices community favor decentralization since it enables collaboration — one team can develop a microservice that can be utilized by others to solve a similar problem. Microservice architecture also favors decentralized data management, given that in a microservice application, each service typically manages its own database.

We host a free educational Webcast series where you can learn how you can leverage microservice-based APIs to fast-track your digital transformation.

How do microservices communicate?

We’ve established that microservices are self-contained mini-programs and that each microservice performs a specific function. To get a better understanding of microservice architectures, we must look at how they communicate with each other.

On the larger scale — looking at a microservice-based platform as a whole — we see a distributed system that runs on multiple processes or services. Therefore, multiple microservices typically need to interact to respond to a request. This poses the question of how microservices communicate.

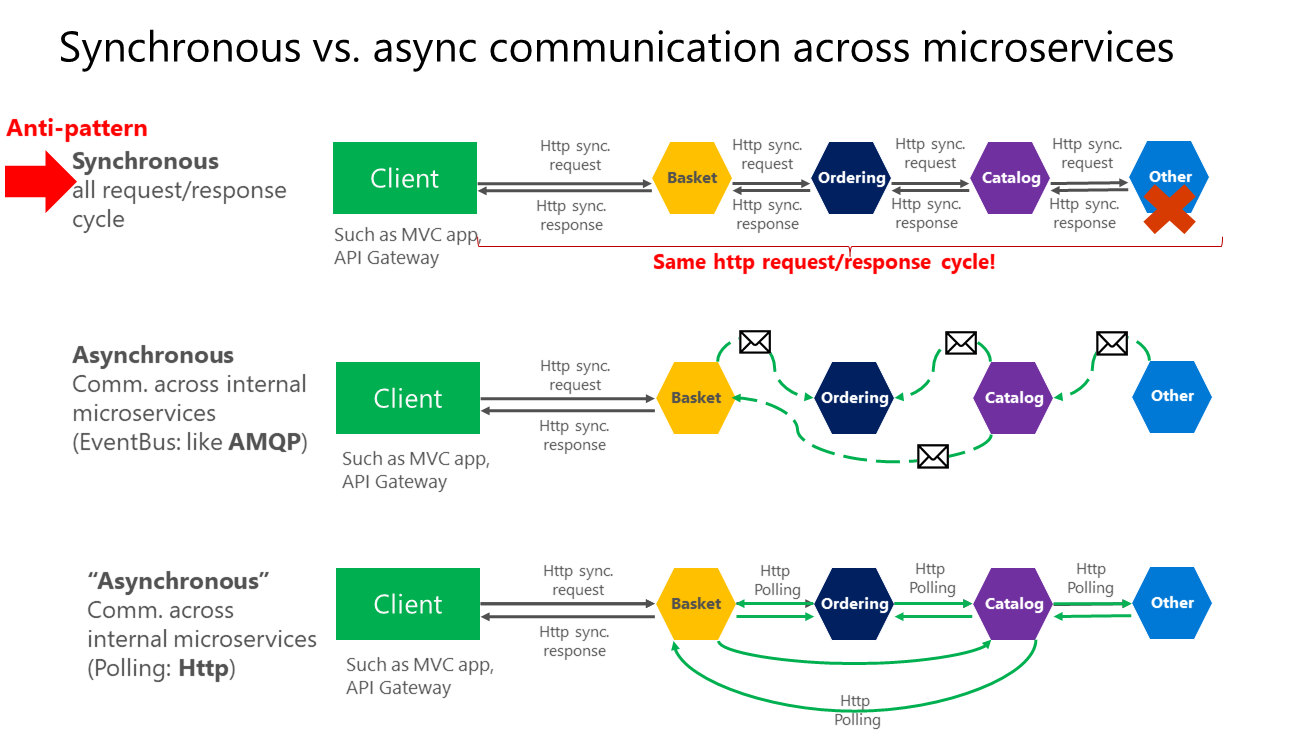

Microservices can communicate using different protocols, depending on the nature of the application and the goal the communication should accomplish. The two commonly used protocols are HTTP request/response with resource APIs and lightweight, asynchronous communications. Communication between microservices can either be synchronous or asynchronous.

Synchronous protocols — When using synchronous protocols like HTTP, the client sends a request and must wait for the HTTP response from the service. While this allows for faster data transfer, the client must receive the HTTP response first, before continuing with the task.

Asynchronous protocols — With asynchronous protocols, the client code or message typically doesn’t wait for a response but sends the message the same way it would to a RabbitMQ or other message brokers.

Microservice-based applications often rely on both types of communication. They typically rely on synchronous protocols like HTTP when invoking a regular Web API HTTP service. The interaction between internal microservices is usually lightweight, asynchronous, and relies on messaging protocols.

Figure 2: Patterns and anti-patterns in microservice to microservice communication; Image source: Microsoft

Anatomy of microservices infrastructure

Let’s peer inside microservices for a moment so you can get a better idea of how they work. In essence, a microservice consists of three separate parts: the data store, the application logic, and an API.

Data Store

Microservices provide functionality based on the dataset they utilize. The consensus within the microservice community is that different microservices should never share the same data. A microservice should have its own data store, and other microservices shouldn’t be allowed to call that data store directly.

There’s a practical reason behind this approach — the developers can make changes to individual data stores without impacting other microservices. This speeds up the development and testing process significantly.

Another argument in favor of separate data stores is the ability to rely on databases that best align with the functionality of the specific microservice. This allows developers to, for instance, take advantage of both SQL and NoSQL databases within the same application.

Additionally, polyglot programming enables APIs and application logic to be written in whatever language best suits the situation, allowing developers to create a perfect blend of functionality and efficiency.

Application Logic

Application logic implements a specific functionality, typically related to a business process or a supporting function. It tells us what function the microservice should perform and how it will perform it. Most decisions related to software architecture depend on application logic, such as which programming language the developers will use and how the application will be composed.

Application logic is inherently intertwined with business requirements, as they need to be built into the application logic to implement certain business processes and provide a specific service to the customer.

The challenges when developing application logic are typically developer-centric — creating simple, yet effective solutions for complex problems, writing the code, and testing to ensure that the application logic works as intended.

The API

The API (Application Programming Interface) is essentially the part of the software the customers get to see and interact with. An API is the interface component of a microservice that exposes access to the data the microservice manages.

Depending on the function of the microservice that exposes the API, the API has to be written in a specific way.

For example, a customer might be interested in the pricing plans your company is offering. Here, the pricing microservice will expose the pricing API that provides the necessary information to the customer. This is the only role this particular API fills, given that the microservice architecture favors narrow, specific tasks.

If you wanted to offer custom pricing plans or provide quotes for your services, a different microservice would be used to collect customer information — like name, email, phone number, and title. This means that the second microservice will have a different API, one that will show the customer the form they need to fill.

The general rule of thumb regarding APIs is that they should retain previous functions when you introduce new ones. Replacing the original functionality of an API may break workflows or lead to cascading failures.

An important thing to remember is that APIs are just one of the microservice components. A good number of businesses planning their digital transformation strategy use microservices and APIs interchangeably.

While the two are closely connected, it’s essential to make the distinction between them. In simple terms, APIs are interfaces, while microservices are mini-programs that execute a specific function.

One thing to note here is that the difference between APIs and microservices isn’t purely semantical. It’s possible to implement microservices without exposing APIs, as well as create APIs without using microservices.

Watch free demos on our website and see how you can modernize your legacy systems and scale your business with microservice-based APIs.

How microservices leverage legacy IT to enable DevOps

Your legacy IT systems have been evolving for years, if not decades. They are the backbone of your business operations, so they’re most likely not going anywhere. At the same time, the monolithic architecture is in direct conflict with what agile workflows and DevOps aim to accomplish.

The DevOps environment requires the developers and operations engineers to work together and focus on developing individual features and functionalities of an application iteratively, rather than build the application as a whole from start to finish. This allows them to continuously provide value and create higher quality software, faster.

New companies and tech startups can simply opt to embrace DevOps from the get-go. For well-established enterprises, that isn’t an option. The dependency between complex, monolithic legacy systems directly opposes the core principles of DevOps since updating one system requires recoding and testing for stability in other systems.

The problem lies in the fact that migrating from legacy IT to modern systems is a high risk, expensive, and time-consuming endeavor. At the same time, maintaining the status quo is a guaranteed way to lose out in the long run, as your competitors embrace innovations, improve their business capabilities, and provide more advanced services to clients.

Thankfully, microservices can be the much-needed bridge between legacy systems and modern DevOps. They provide a much more efficient alternative than the “all-or-nothing” approach to DevOps, one that enables you to access legacy data and incorporate it into agile projects.

Microservices can bypass the intricate layers and connect directly with your monolithic legacy systems to gain access to their data points. This allows you to leverage the existing architecture and utilize the wealth of stored data while adopting an agile approach and developing services independently.

Monoliths vs. Microservices

|

Monoliths |

Microservices |

|

|

Architecture |

Built as large, single-logic executables, where all the functionality is crammed into a single process |

Each microservice is self-contained, with singular functionality, and can be deployed independently |

|

Modularity |

Largely based on the programming language features |

Based on business capabilities |

|

Implementation |

Usually written in one programming language |

Can be written in a variety of programming languages, allowing developers to use the one that best aligns with the microservice’s function and best suits the business needs |

|

Agility |

Any changes or upgrades to the system require extensive recoding and testing and deploying a new version of the application |

Changes can be applied to any microservice, and new microservices can be implemented without affecting the integrity of the system |

|

Scalability |

The entire application must be scaled horizontally |

Each service can be scaled independently |

With well-designed APIs, microservices can utilize your legacy systems as an extensive data source for your agile workflows. In other words, microservices allow you to embrace technological innovations, improve your business capabilities, enhance your services, and meet the evolving customer needs.

They’re not merely a modern way to build a backend architecture — microservices represent an intersection between DevOps and Legacy IT.

Who uses microservices? Microservices architecture examples

Microservices are only limited by the developer's creativity. Any business that provides any type of digital service can leverage microservices, regardless of the industry. This includes everyone from banks and e-commerce stores to giants like Netflix.

As monolithic architectures fail to answer evolving business needs, the number of companies relying on microservices is rapidly increasing. Here are a few microservice architecture examples of hugely successful companies that base their business operations on microservices.

Amazon

Up until 2001, Amazon relied on a massive monolithic architecture. As the business rapidly grew and expanded its online presence, it became apparent that Amazon’s legacy system couldn’t handle the massive amounts of traffic.

Apart from making it difficult to meet the rapidly evolving traffic demands, during the Amazon re:Invent conference in 2015, Rob Birmingham, Amazon AWS senior manager, highlighted another issue of the monolith architecture.

They noticed that it took weeks for any code changes to go from developer check-ins to implementation. This meant customers had to wait for a long time before a new or upgraded function was introduced to the site.

Today, Amazon heavily relies on microservices, and their AWS (Amazon Web Services) provides the necessary microservices infrastructure for companies that want to launch and manage containers and microservices.

Netflix

Netflix encountered a similar problem — as the number of users rapidly grew, the monolith architecture couldn’t handle the load, and the company was experiencing regular server outages.

Netflix turned to microservices as the solution back in 2009, when the technology was still new and relatively unexplored. The company leveraged AWS to set up its microservice architecture.

Netflix opted for a step-by-step approach, and the architecture redesign took two whole years. They first transitioned all the movie encoding and other non-customer facing applications to microservices, then worked on decoupling customer-facing aspects of the application, such as account creation and video selection.

It’s precisely this switch to microservice architecture that enabled Netflix to grow to outstanding proportions.

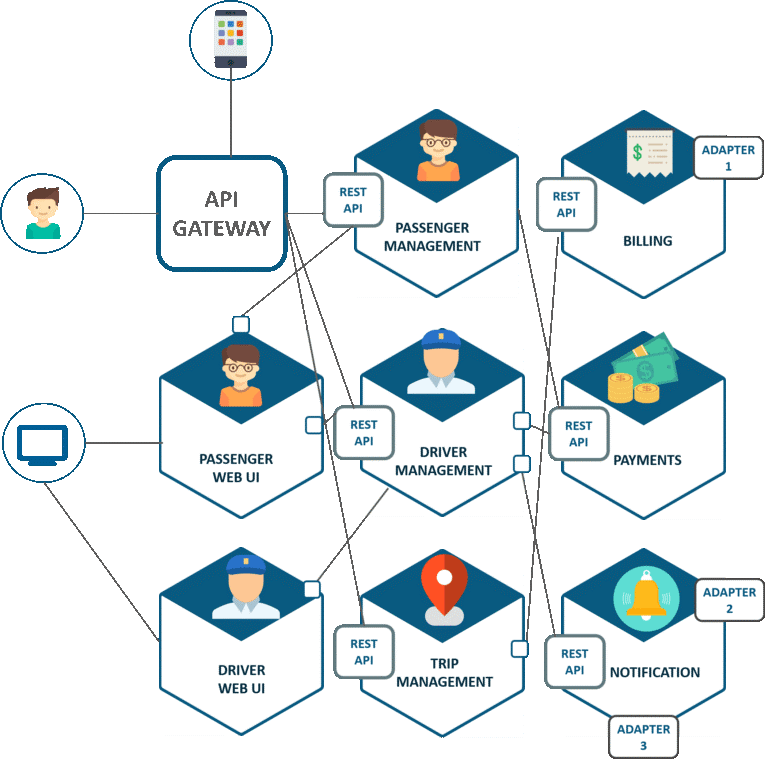

Uber

Although a global service today, Uber started out as a solution meant to serve only the city it was founded in — San Francisco. In its early days, Uber had a monolith architecture, which soon proved to be inadequate as the service spread to other cities, and eventually, all over the world.

The monolith architecture hindered the company’s progress, as they ran into issues with scalability and integration as the app grew.

The perfect solution that didn’t require them to abandon their existing architecture was switching to microservices and leveraging API gateways. This allowed Uber to create, deploy, and scale individual functions of the application independently, without compromising the integrity of the app.

Uber microservice architecture

Figure 3: Uber’s microservice architecture; Image source: Dzone

The major benefits and business impact of microservices

As we can see from the examples above, microservices are a key element of a successful digital transformation.

For most businesses that rely on legacy IT systems, they are a necessity, not an option. Transitioning from monoliths to microservices offers various benefits to your organization.

The major benefits of microservices include:

- Improved scalability

- Increased business agility

- Fault isolation

- Compartmentalization of knowledge and complexity

- Improved productivity

- Reduced time-to-market

- Easier maintenance

- Increased customer satisfaction

- Future-proof applications

Improved scalability

Since microservices can be deployed independently, without affecting the application as a whole, it’s much easier and way more cost-effective to scale services in a microservice architecture than in a monolithic system.

Making changes to existing services and adding new business capabilities comes down to tweaking individual microservices or adding new ones, rather than recoding and retesting the entire application. This dramatically improves the development speed without affecting application stability.

Increased business agility

Microservices facilitate DevOps and enable agile workflows due to the fact that different developer teams can simultaneously work on different features and services. Individual microservices can be developed, tested, and deployed within days, allowing customers to immediately take advantage of new services, rather than waiting months or years for new versions of the application.

This approach also allows organizations to adapt to changing requirements and prioritize different features and services based on customer feedback.

Fault isolation

If one microservice fails, the others will continue to function without any issues, since they’re based on individual data stores and application logic. Another advantage of microservices, thanks to their independent nature, is the fact that you can experiment with new processes and business logic since the failure of a single microservice won’t render the application as a whole unusable.

Compartmentalization of knowledge and complexity

The microservice architecture allows developers to approach each microservice as a separate, isolated, self-sufficient mini-program.

This means that the developers only need to understand the complexity of the microservice they’re working on, without having to worry about the programming language, application logic, or data stores of other services. Service owners only need to know what capabilities other services provide, without bothering themselves with how they work internally.

Compartmentalization of knowledge and complexity makes it infinitely easier to develop and manage large applications.

Improved productivity

Since developer teams only need to focus on the task at hand, they can be much more productive. It’s much easier to understand a single functionality within a microservice than the inner workings of an entire monolithic application.

Reduced time-to-market

With an agile workflow, improved productivity, and faster development and testing times, organizations using microservices can deploy their software and services much faster. In a highly-competitive online business environment, it’s imperative to integrate new technologies and offer advanced solutions to your customers as fast as possible.

Easier maintenance

The independent nature of microservices makes it much easier for developers to debug code and perform maintenance. With shorter development cycles that focus on singular functionality, testing, debugging, and maintenance become routine tasks, rather than being pushed all the way back to the end of the development cycle, as is the case with monolithic applications.

Increased customer satisfaction

Microservices are built around business capabilities, making it easier for developers to understand the user perspective behind each microservice and create APIs that provide value to the customers.

As business capabilities and technology changes, and the needs of customers evolve, developers can easily add new functionalities to existing microservices or introduce new microservices into the architecture. Being quick to respond to user feedback and deploy solutions that meet their needs inevitably leads to higher customer satisfaction.

Future-proof applications

The IT industry is continuously changing and evolving, making it rather tricky how future technological innovations might affect your application. Although this might be a major concern with applications based on monolithic architectures, microservices aren’t as vulnerable to constant changes.

As new and updated technologies are made available, organizations relying on microservice architecture can simply replace, upgrade, or add new microservices instead of having to redesign the entire application.

Business impact of microservices

So far, we’ve talked about the various features of microservices and the theoretical benefits they can provide to an organization that wants to modernize its legacy IT systems. Deploying microservice-based APIs can help you drastically reduce your time to market, utilize fewer resources in your digitization efforts, and significantly boost your ROI.

That said, we don’t expect you to simply take our word for it. We’ve worked with dozens of high-profile clients and helped them create microservice-based APIs that enabled them to embrace innovations and deliver outstanding services to their clients, at a fraction of the cost.

Here are some of our case studies, to show you the impact microservices can have on your business, using real-life examples:

Banking

Credicorp Bank implemented 30 microservices and 70 legacy APIs in 10 weeks. They used 50% fewer resources and achieved 300% faster API performance.

Leading Israeli bank managed to bypass complex and heavily customized ESB and deliver five microservices in just two weeks.

OpenLegacy helped a top 10 global bank develop and implement six key global APIs in just two weeks. See how we implemented the perfect solution to the problem nearly 200 developers have been working on for a year, in just 14 days.

Telecommunications

Bezeq modernized its major portal without expensive middleware or proprietary software. See how OpenLegacy delivered 8 rest APIs for the company in just three days, alongside the SAP Human Capital Management module for expense reporting, providing much-needed flexibility.

Healthcare

See how Farmacias leveraged OpenLegacy’s microservice-based APIs to quickly integrate Oracle RMS and cut down development time by 30%!

Microservices Best Practices

Microservices aren’t exactly a novelty in the IT industry. As you’ve seen through the examples provided in this article, companies have been relying on microservices for over a decade. Over time, microservices evolved as companies learned the dos and don’ts of building microservice architectures.

Today, microservices are less complex than they used to be some ten years ago. The question today isn’t whether or not you should switch to microservices — you should. What organizations should be concerned about today is how to properly develop and integrate microservices to enable easier scaling, speed up development cycles, facilitate changes, rapidly embrace innovations, and support business agility.

To meet these goals, organizations should follow a set of best practices when transitioning from legacy systems to modern microservice architectures.

Microservices best practices include:

- Bypass layers when possible

- Have separate data storages

- Use appropriate technology for each microservice

- Secure all levels

- Build dedicated teams

- Leverage automation for faster deployment

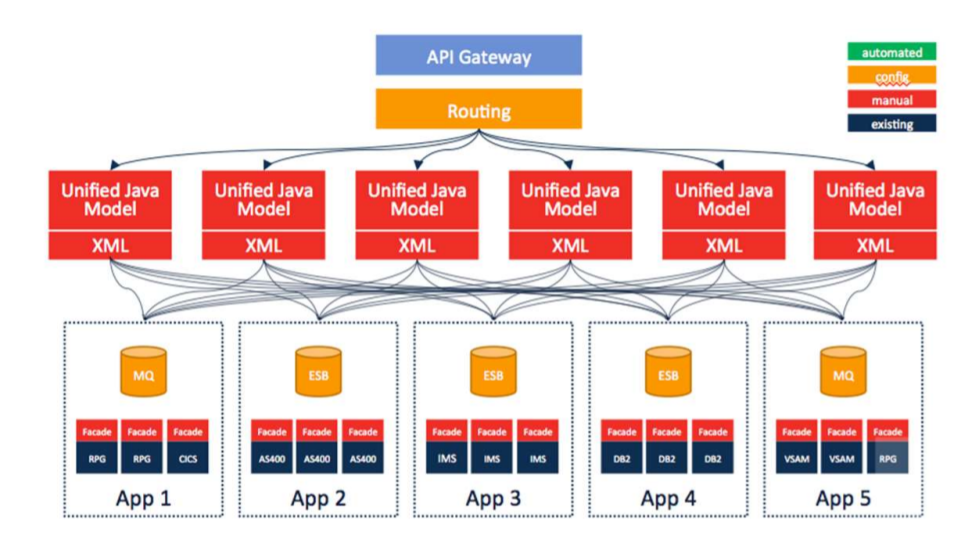

Bypass layers when possible

If you’re new to microservice architectures, integrating microservices with a legacy system may appear like a daunting and difficult task. True enough, developing and deploying microservices in the past did require navigating through multiple complex layers of the existing architecture.

Figure 4: “Typically, integration microservices have been hard to create, largely due to complex, manual effort”; Image source: OpenLegacy

With modern microservices-oriented architectures, this is neither necessary nor desirable. Deploying microservices today enables (and encourages) bypassing layers whenever possible and connecting directly to the mainframes, midrange systems, and databases within your legacy systems.

Here at OpenLegacy, we follow the logic of your legacy system to determine the best way to connect to the system. This information can be used at run-time, with pre-built connectors, to bypass as many layers as possible and automatically connect with the legacy system.

This eliminates unnecessary complexity and enables faster microservice creation, without the need for special programming skills like COBOL and RPG, or invasive changes to the underlying systems.

Have separate data storages

We’ve explained that each microservice should have its own data storage. Failing to do so will lead to the high dependency between individual microservices, where changes to a single data store may cause issues with other microservices reading that database or message queue directly.

This does not imply that multiple microservices cannot share data—it only suggests that data sharing should be done through APIs.

Use appropriate technology for each microservice

You should always strive to use the appropriate data management option and programming language that align with the functionality of the specific microservice best. The former is known as polyglot persistence, while the latter is called polyglot programming.

Combined, the two will enable developer teams to use the right tools for the job. Even if the organization prefers a specific programming language, like Java, for some functionalities, other languages like C or javascript may be more efficient or simply better alternatives.

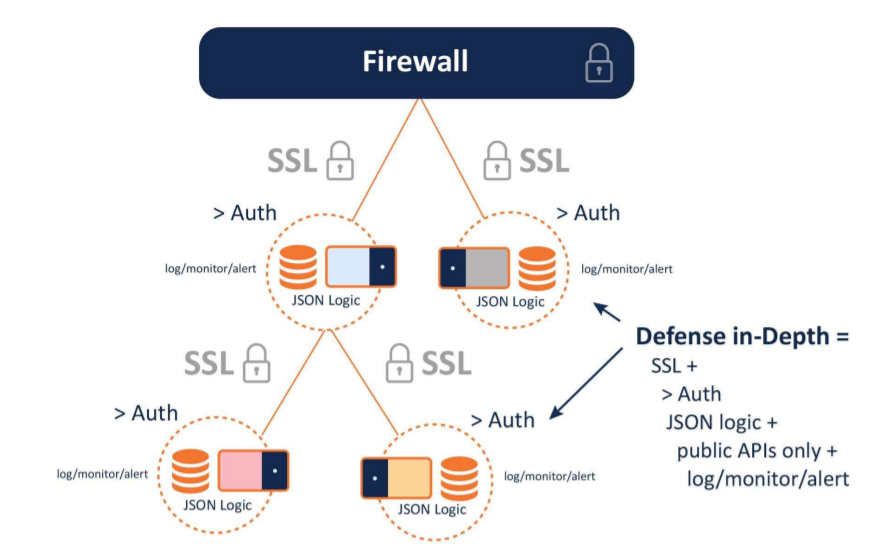

Secure all levels

One of the concerns regarding microservices is that, given that each microservice is an independent, separately runnable unit, they don’t enjoy the same level of security as components in a monolithic application.

Developers have somewhat mitigated this issue by running microservices behind an API gateway that acts as a firewall. That said, API gateways alone don’t offer sufficient protection, and microservices must not be left vulnerable to cyber threats that might penetrate the API gateways.

That’s why it’s critical to include additional layers of security. For instance, the communication between microservices must be SSL encrypted, and oAuth should be used to verify user identity. On top of that, programmers must compensate for the inherent vulnerabilities of JSON by addressing them through the application logic within the microservice.

Figure 5: “Due to their unique nature, microservices require multiple levels of security”; Image source: OpenLegacy

Another recommendation is to never allow microservices to run on a public network. Programmers should also follow certain guidelines, like:

- Logging every significant event

- Implanting automated monitoring

- Generating alerts when necessary

Build dedicated teams

When developing and implementing microservices, the developer teams should function similarly to their creations. Just like microservices, the dedicated teams should be self-sufficient — cross-functioning teams with varied skill sets are the best choice since they’re organized around the capabilities they are creating and managing.

While developers might find it difficult to grasp the end-to-end scenario in large applications, with microservices — they don’t have to. With each developer team responsible for the microservices it created, managing the microservice architecture becomes a lot faster and much more efficient.

Leverage automation for faster deployment

The main selling point of microservices is the ability to deploy them independently. Still, manually testing and deploying each microservice you create would be tiresome, costly, and time-consuming.

When adopting a microservice architecture, it’s best to implement an automation structure. With automated testing, for instance, you cut down the time it takes to perform the necessary tests from days to hours. Automation also enables you to wrap microservices in containers, making them easier and faster to deploy in any environment, including the cloud.

Take any core system to the web, mobile, or cloud. Generate APIs in minutes. Deploy microservices anywhere.

Considerations when switching to microservices

Although switching to microservice architecture can provide a myriad of benefits, the transition doesn’t happen overnight. Certain preconditions regarding staff, the environment, and the project management approach must be met before you can start working on microservice development.

Here are a few things to consider when embracing microservices:

Business competency

We’ve established that microservices should be developed using the technology that best aligns with their functionality. This means that developers will likely need to leverage multiple databases and rely on various programming languages when developing different microservices, not to mention be familiar with the microservice architecture.

Since microservices should be developed and deployed independently, it’s necessary to create cross-functional teams with diverse skill sets. Therefore, the organization as a whole should embrace DevOps and agile workflows to maximize productivity and ensure efficient implementation of microservices.

It’s important to consider the personnel cost and organizational expenses before you make the commitment to switch to a microservice architecture.

Code maturity levels

All the code within a microservice should have the same level of maturity and stability. Should you need to rewrite the existing or add new code to improve its functionality, the best approach is to create a new microservice to replace the old one.

This enables the existing microservice to continue running and keep providing the associated business capability. At the same time, you’re free to test out and polish the new code to make sure it’s error-free before replacing the existing microservice.

Tools at your disposal

Carefully consider what tools you’ll have at your disposal and how you’re going to deploy microservices. Deploying them in containers allows you to leverage a single tool and facilitates the implementation of microservices.

Stateless servers

Microservices can — and usually do — run on separate servers. Stateless servers have proven to be the best option, given that they don’t require the client to establish a prior connection to the server. This makes it easier to recover from server failures and fix any ill-functionality, as well as simpler, more robust, and easier to scale.

Monitoring everything

In a microservice ecosystem, the application has a lot more moving parts compared to monolithic systems. This makes it necessary to monitor everything, from response time notifications and service error notifications to dashboards, in order to ensure everything is working properly.

Potential drawbacks of microservices

Before transitioning to a microservice architecture or integrating microservices with your legacy systems, you should also be aware of the potential drawbacks. While microservices are undoubtedly a huge step in the right direction for organizations that want to embrace innovations, improve business capabilities, and upgrade their services — they do come with their own cost.

The potential drawbacks of microservices include:

- Complexity of microservice architectures

- They require thorough planning

- Lack of control over third-party microservices

- Proper sizing of individual microservices

Complexity of microservice architectures

On a small scale, individual microservices may be easier to comprehend, deploy, and manage, the entire architecture and the application as a whole can end up being quite complex. The high number of interconnected components within an application can make it increasingly complex and difficult to manage. It can also cause problems the developers might struggle with.

They require thorough planning

Although independent and self-contained, all microservices within an application indirectly work together to make up an application that provides a variety of services the end-users can utilize. That’s why it’s essential to plan out the functionality of every individual microservice, as well as break down their dependencies.

If you’re integrating microservice-based APIs in a monolithic application, you must also figure out where each microservice will pull the data from. Despite thorough planning, some trial and error may be necessary before you get everything right.

Lack of control over third-party microservices

It’s common practice in the microservice community to make certain microservices public, as a way for developers to help each other solve similar problems without having to start from scratch. That said, relying on third-party microservices means you have no control over them.

When the third-party services change their APIs, they might impact your application in major ways, sometimes even breaking some of its functionalities or the app as a whole. Whenever any API modifications take place, you should be able to respond as quickly as possible.

Proper sizing of individual microservices

The question you must ask yourself when developing microservices is — “How micro should microservices be?” The general rule of thumb is that microservices should be as small as possible, but not smaller.

What we mean by this is that with larger microservices, you might experience the same drawbacks of monolithic architecture. Simultaneously, making microservices too small will increase their dependencies and make them more difficult to manage and scale. Dealing with complex dependencies between microservices will likely require exceptionally skilled and higher paid developers and microservices architects.

The future of microservices

Microservices have become a necessity for any business that wants to stay competitive in the digital era. We’ve seen the part microservices played in the growth of giants like Netflix, Amazon, and eBay. Whereas in the past, microservices represented an excellent option to scale your enterprise, today they’ve become the staple of every forward-thinking business’ digital strategy.

As the technology advances and customer needs evolve, and more companies embrace a cloud-native architecture, microservices and microservice-based APIs continue to prove their worth and solidify their place in the IT industry.

Today, microservice architectures are used by companies all over the world. The importance of microservices in a digital business environment cannot be overstated. Given the fact that various industries — health, banking, retail, entertainment, etc. — have become heavily reliant, if not dependent on microservices to quickly deliver digital services, it’s evident that microservices are here to stay for years to come.

That said, not many organizations have the knowledge, skills, and business competency necessary to build complex microservice architectures, integrate microservices with their legacy systems, and deploy microservice-based APIs.

That’s where we come in to offer a helping hand and become a trusted partner that will make your legacy systems digitization quick and painless. We help you create digital services without being held back by your legacy systems, so your business can thrive in the digital age.

OpenLegacy leverages microservices to connect your legacy systems with mobile, cloud, or web solutions with lightning speed and create advanced APIs for all your business needs, in minutes!

Our fast, easy-to-use API integration tools will enable you to embrace microservices technology and create digital solutions from your legacy systems faster than you thought possible.

Rather than abandoning your legacy systems and spending insane amounts of time and resources creating new ones, OpenLegacy allows you to leverage your existing monolithic systems to deliver outstanding digital services to your customers or for internal integrations.

To leverage digital innovations 10x faster, learn more about us at OpenLegacy.

We’d love to give you a demo.

Please leave us your details and we'll be in touch shortly