Learn all you need to know about mainframe to cloud migration: why you need it, the challenges you might face, and options for mainframe modernization.

The Many Benefits of Insurance Legacy System Transformation

Did you know that many institutions like yours are currently looking to grow their business through insurance legacy system transformation?

“Digital transformation” is a term that gets tossed around frequently in conversations, mostly because moving away from outdated and inflexible on-premise systems is the first big step toward modernizing an organization

Industries like financial services have long led the way. Initially, they had the most to gain, as operational agility is number one when dealing with high-risk and volatile financial markets. For a long while, however, the insurance industry was hot on its heels.

Then the COVID-19 pandemic occurred. This demonstrated the robustness of the industry to withstand disruption and uncertainty, even while a majority were still functioning on old systems and outdated applications.

Perhaps that’s why, within the insurance sector, progress seems to have temporarily halted, with some still erroneously believing their systems are “fine” and “up to the task”.

Is this really the case, though, or should the industry now be taking a leaf out of banking’s book and making some major changes?

Let’s take a look in the article below.

What are legacy systems in the insurance industry?

Legacy systems are those aging and obsolete business tools that are still in use. These include unsupported platforms, applications, and outdated mainframes and servers.

For a variety of reasons, many organizations find themselves using applications or entire monolithic systems that are far behind in what they can offer companies when compared to modern solutions.

Many insurance companies stick with their legacy systems because they perceive them as being “good enough” to meet business needs or feel tied to them due to the complexity and perceived disruption of an insurance legacy system transformation.

Many insurance companies stick with their legacy systems because they perceive them as being “good enough” to meet business needs or feel tied to them due to the complexity and perceived disruption of an insurance legacy system transformation.

In most cases, these are poor excuses and short-sighted. For starters, every month that passes signals the increasing decline of these legacy systems in terms of security, compliance, compatibility, and performance. Additionally, the further they lag, the greater the end-user experience falls, negatively affecting employees and customers.

Why embrace cloud-native architecture instead of legacy systems and software?

A cloud-native architecture brings your organization into the modern digital age. While potentially costly to implement and time-consuming upfront, cloud migration of your enterprise system will gift you with new capabilities that bring a higher ROI.

These include:

Scalability

Cloud-native architecture introduces your organization to a new level of scalability. You can easily scale with demand by implementing modern technologies and using programming languages that facilitate containerization.

Other solutions like microservices allow you to use only what you need when it comes to features and capabilities, as well as divest from services when necessary.

Transforming your IT ecosystem can thus remove any legacy-based barriers to organizational growth and allow you to provide truly digital insurance.

Lower costs

Moving to the cloud means you can significantly lower IT operating costs too. You can ditch expensive equipment like servers and their associated maintenance expenses. Your new platform providers will handle any updating and service upgrades on your behalf.

Moving to a new system will also save your enterprise money by freeing you of the curse of legacy coder erosion i.e. you’ll no longer be reliant on shrinking numbers of specialized IT staff who are familiar with your outdated system - and charge accordingly.

Automation of your internal systems can save time and money as well. Your team will be able to focus their efforts on more complex areas of your business and get more tasks completed in a shorter period.

More secure

Old-hat stakeholders may still perceive hosting on the cloud as a security risk, but this hasn’t been true for a long time. Cloud-based architectures come with enterprise-grade security, and while the public cloud has associated risks, organizations can opt for private or hybrid solutions to counteract this.

For example, in U.S. healthcare, nothing is taken more seriously than patient privacy. In fact, the Health Insurance Portability and Accountability Act (HIPAA) ensures meeting regulatory requirements is the utmost priority for providers.

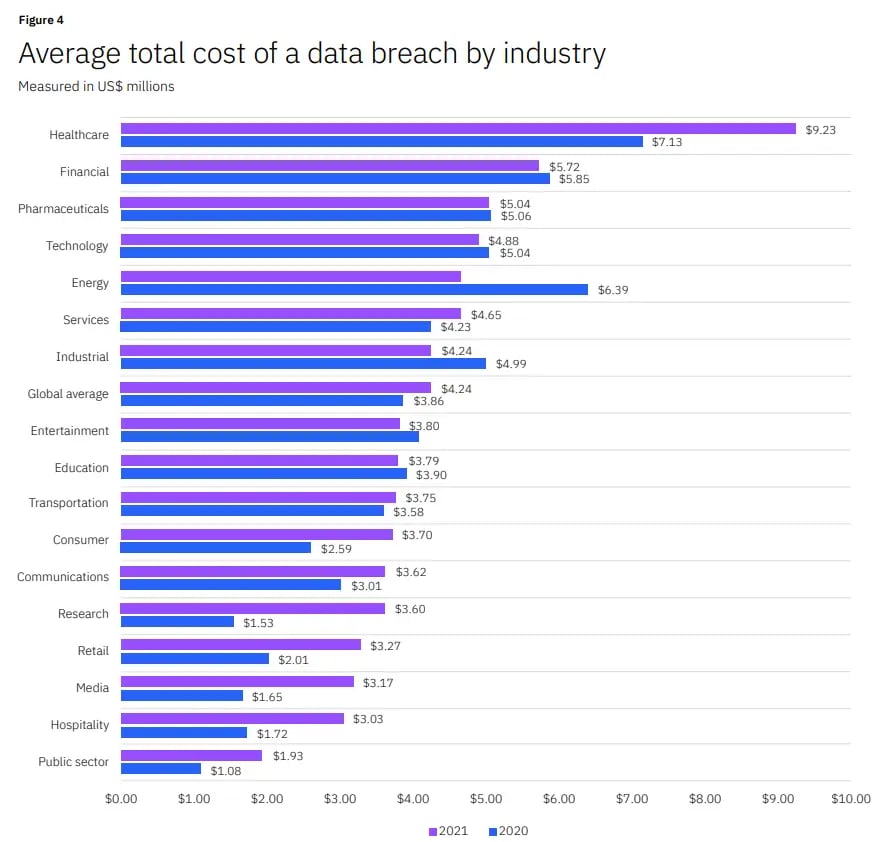

Yet the majority still use legacy systems to run core business processes. A recent report found that 71 percent of Windows-based devices in healthcare facilities were running legacy operating systems.

The result is that the healthcare industry leads the way in data breaches, with the average cost of a breach being 9.23 million dollars. This represents a nearly 30 percent increase from the previous year.

If your organization wants to minimize the risk of storing sensitive information like insurance plans and policies, then cloud migration is an obvious solution.

Information breaches and leaks to malevolent actors and competitors can be disastrous and expensive, but strategic cloud implementations involving private, hybrid, or multi-cloud approaches allow you to selectively silo any part of your business for increased cybersecurity.

Boosted productivity

Modern business solutions employ rapidly evolving technologies such as AI and machine learning. Combined with automation, these business intelligence tools can optimize workflows. Manual and tedious tasks like data entry and email can all be automated with a new system in place.

Much higher-tier tasks, like claims processing, can also be customized and dealt with automatically. This frees your team up to focus on the most important areas of your business.

When you empower your employees with advanced capabilities, you can expect them to perform better in their roles.

More revenue and premium growth

Moving from your legacy system to cloud architecture can also boost your premium growth and bring in more revenue. This is due to the capabilities you gain. These allow your enterprise to react swiftly to changing global market conditions and turn disruption into opportunity with a faster time to market.

Key business processes, like claim handling, underwriting, policy administration, payments, and customer service, can be optimized and enhanced to boost growth. As a result, modernizing your core systems helps you offer more competitive policies and pricing. This means you can out-compete your rivals and see higher yearly premium growth.

A quality digital experience

The growth of Insurtech undoubtedly marks a sea change. Modernizing your legacy insurance system allows you to join the ranks of these digital insurers and implement flexible operating models.

Remember, modern consumers have ever-increasing expectations and demands. They want self-service options, rapid quotes, and instant policy access. With a cloud system, you can give them the newest and most desired features and also sell directly to the consumer more easily.

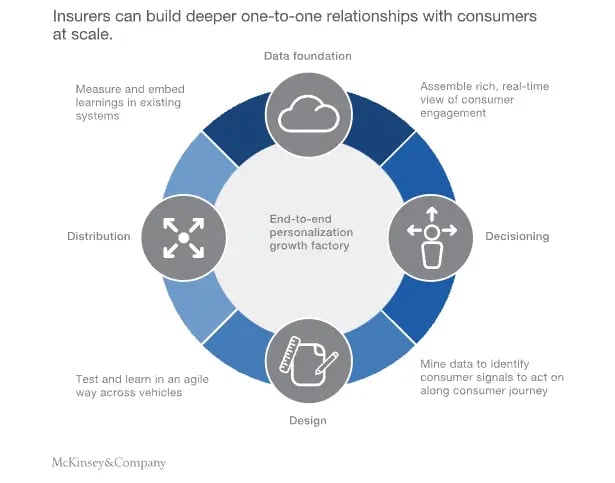

McKinsey estimates that better personalization of services reduces the cost of new customer acquisition by as much as 50 percent.

A high-quality digital experience will benefit employees too. For example, a cloud-based enterprise system lets your team personalize interfaces, reporting dashboards, and other features to help maximize their work outputs.

By migrating to the cloud, your organization will also be able to acquire and retain candidates that desire flexible remote or hybrid working environments.

Why do insurance institutions still prefer legacy systems?

The decision to modernize your enterprise system and software seems like an easy choice when weighed against the benefits. However, despite it increasing performance and giving you a competitive advantage, many institutions prefer the comfort and familiarity of legacy technology.

Admittedly, we can’t entirely blame them for dragging their feet, and there are plenty of justifications that organizations cling to that prevent or delay system upgrades. These include:

Doubts about cloud computing

From the top to the bottom of an organization, there will be those who have their doubts about any new tech. Decision-makers and primary stakeholders may be especially apprehensive about cloud computing. Many fear it will prove unreliable since its services require network connectivity to off-premise infrastructure.

A popular misconception is that building your system with cloud vendors adds increased risk for things like security and compliance. In reality, it’s the opposite. Platform providers are constantly updating their security technologies, and vendors also tend to stay up-to-date with local and global compliance requirements. This means less legwork for your IT and DevOps teams.

Time and cost

There’s no getting around this elephant in the room. Upgrading or replacing enterprise legacy solutions requires time and money – the two most essential resources to a business. For large regionals and multinationals, the task that lays ahead is the primary obstacle standing in the way of operational enhancements.

Depending on the size and nature of your business, each organization will have a different tolerance for the disruption caused by such projects. Luckily, legacy modernization doesn’t come with a one-size-fits-all roadmap.

There are diverse approaches enterprises can take to contemporize their business tools. Careful consideration must be given to development lead times and a deployment strategy. At the same time, resources must be in place to maintain a functional legacy system throughout the project life cycle.

For example, a smaller organization may be more resilient when it comes to a complete rebuild as its operations are relatively simple. A globalized multinational, on the other hand, will have too many moving parts for a complete shutdown. They’d instead want to look at intermediate options like modernizing code (rearchitecting), rehosting, or adding new technologies in tiers (refactoring).

Additional training

A legacy system transformation will cause disruptions to business continuity, costing time and money. This will primarily occur during the development and continuous deployment of the project, but the work isn’t complete even once the switch has been made.

Next up is training and onboarding for everyone in the organization. Staff education for new business tools comes with challenges of its own. Some team members may be stuck in their ways and resistant to different ways of doing things. Others may find it difficult to learn to use new tech.

Mastering a new enterprise system can require days, weeks, or even months of training depending on the variables involved. It goes without saying, but the more outdated your legacy system is, the more foreign modern tech will feel to your team.

Stakeholder input should be part of any onboarding strategy. Focus on maintaining or resuming business continuity as quickly as possible so as not to affect customers or your bottom line.

The company relying heavily on its legacy system

One survey found that reliance on legacy systems was the main barrier to digital transformation for 38% of respondents.

Some insurance carriers are heavily entrenched within their legacy systems. They may have been using this for a decade or more (the average life expectancy of a business solution is around six to eight years).

Of course, the way to avoid this is to implement a strategy of continuous improvement for your tech stack.

Nevertheless, the time for more subtle and intermediate modernization strategies has passed. These organizations are looking at a replacement as their only viable option, but the amount of disruption this will cause could break their business - at least in the short term.

This means they won’t be able to run day-to-day operations during any legacy system transformation. However, the technology gap is only growing wider as these organizations continue to procrastinate, meaning they do so at their peril.

Tips for an effective legacy system transformation

There are no two ways about it: a legacy system transformation is a massive project. Upgrading or rebuilding will affect every area of your business, so it should not be taken lightly. Appropriate due diligence must take place.

To maintain organizational continuity during a modernization project, follow these best practices.

Avoid a laser focus on certain issues

When it comes to an industry like insurance, the devil is in the details. You’re wired to focus on outwardly insignificant areas and glean insights for improvement and opportunity from these. This way of thinking is great for navigating a highly competitive landscape.

For a project like a legacy transformation, however, laser-focusing on specific components, features, infrastructure, or other areas can be a hindrance to getting off the ground. Instead, enterprises must take a holistic approach when planning a digital transition of this scope.

A big-picture view will allow you to weigh benefits against pain points for various modernization strategy options. This will ensure you get the greatest business value out of whichever methodology you pursue.

Identify your objectives

Before planning any form of legacy modernization, you need to first identify your objectives. This means performing a comprehensive assessment of your legacy system. What does it do well? What are its flaws? What features or capabilities do you need to take your business to its next level of growth?

For example, you may be looking to add enhanced and personalized experiences for customers while keeping many of the same backend processes for things like premium costing. Or you may want to completely migrate to a customized, cloud-based architecture to help you implement microservices and AI automation throughout various business areas.

Take inventory not only of the functions your current system performs but also those capabilities that the organization doesn’t find useful. This auditing process should guide primary stakeholders toward a consensus on project objectives.

Consider open APIs

A full rebuild or replacement may be the best solution for your organization, but you might also be able to meet the same objectives using a less invasive approach. By leveraging API technologies, you could see the results you need by implementing an intermediate modernization strategy instead.

Open APIs can be used to repurpose various components of your existing legacy system. In other words, they can take over many features and functions of your software while letting you keep enough of it to maintain an adequate level of business continuity. They can give you access to powerful AI and automation to save time and money too.

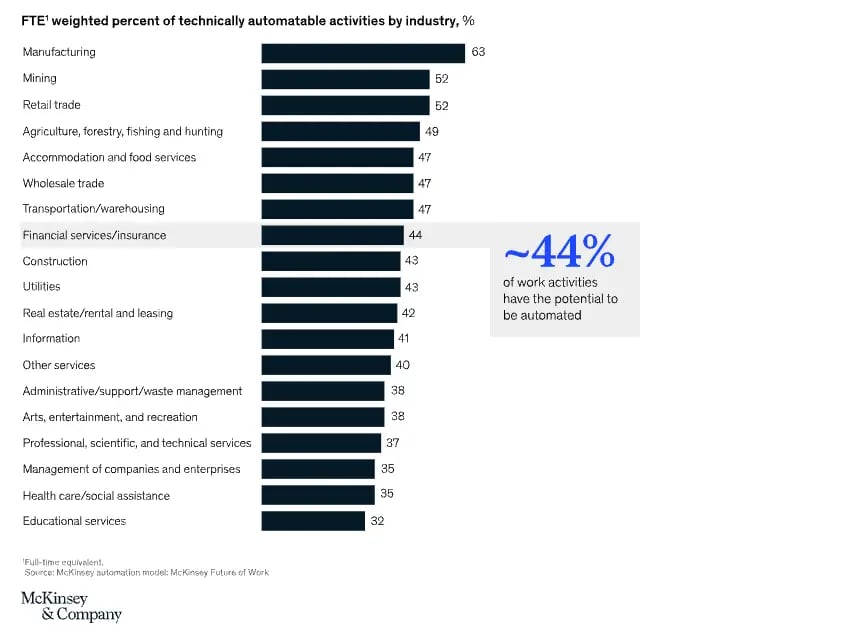

According to McKinsey, the insurance sector has a lot to gain from this sort of technology, with 44% of work activities that can potentially be automated.

An API integration platform enables users to easily identify and use the microservices their business needs. This methodology thus represents a viable approach to the rapid deployment of InsurTech-like innovations.

If your organization has been neglecting modernization, leveraging cloud-based applications offers an efficient and effective fix that doesn’t compromise continuity.

Build streamlined and innovative strategies

Only the best-laid plans truly succeed, and success means project delivery on budget and on time. While it’s mostly those at the top who will build a roadmap, it’s recommended you involve team members from every department. After all, it's the developers, engineers, salespeople, and customer support representatives who know what’s lacking with your current monolithic system.

Many non-managerial employees in your organization will know of cutting-edge and niche technologies that can serve to enhance productivity and boost other areas of the business. However, you’ll only find this out by involving them in your plans.

Consider creating a centralized base for project R&D that gathers feedback from customers and team members but reports to the project manager and key stakeholders. Platforms that provide flexible legacy modernization can streamline the planning and implementation process for your organization.

This type of collaboration ensures you can develop an innovative business strategy that goes hand-in-hand with your insurance legacy system transformation.

Examples of Insurance Legacy System Transformation

Liberty Mutual needed a more efficient way to deal with hundreds of green screens and thousands of user scenarios. OpenLegacy automated the generation of Java code so it would be re-useable across many interfaces. The green screens were old and slowed down data access and entry, significantly affecting productivity and ultimately sales. The Liberty Mutual development team captured all the screens using as few trail files as necessary. They then put the Java entity for each screen into a reusable library. Liberty Mutual utilizes many of the AWS cloud and development tools. Now, when a request comes in for a specific scenario, the team easily creates an application that uses the the Java entities (the green screen process) that is needed for that scenario. By leveraging their existing mainframe assets they have been able to quickly deliver new modern to their customers, both internal and external.

Another example is with Legal & General. They had a long-term modernization plan to create a hybrid architecture to separate apps considered softcore systems like document management from heavy apps considered hardcore like Claims Processing. The goal, to migrate softcore apps to the cloud and leave hardcore systems on mainframe. Legal & General also wanted to improve their claims processing systems by incorporating the capability to scale up and down as necessary using microservices. This transformation project capitalized on OpenLegacy’s automatic generation of microservices and APIs to expose existing mainframe business logic and functionality and streamline deployment capabilities to any target architecture. This vital functionality allowed Legal & General to utilize a blended, multi-cloud architecture, which comprised OpenShift and Node/ Lambda on AWS. The OpenLegacy’s cloud-native hybrid-integration technology approach automatically deploys steady load operations to the configured selected environment chosen by Legal & General to OpenShift. Variable load operations are deployed to a serverless Node/Lambda environment. The results include operational and cost efficiencies, streamlined time-to-market, and improved performance speed.

Insurance legacy system modernization FAQs

What is open insurance?

Open insurance is where institutions provide services and data to partners, communities, and startups. These connections are facilitated by open APIs that streamline the access and sharing of data between insurers, startups, banks, and other entities.

Industry innovations and the emergence of the InsurTech industry have driven the need for open insurance. This new movement allows for the creation of new products, services, applications, and innovative business models (such as DTC).

Big-data connections promote more accurate risk analysis and allow insurance organizations to bring new and desirable products to market.

What is a legacy system in insurance?

Today’s insurance institutions are heavily reliant on IT systems to support their core applications and business functions. Legacy systems are the outdated and archaic methods and software they use. These obsolete legacy applications are critical to the day-to-day running of such organizations.

The development of some of these systems goes back as far as the 1970s and 1980s. However, legacy options lack many of the capabilities of modern and cloud-based solutions. They’re therefore a major roadblock for enterprises undergoing a digital transformation.

These systems are not necessarily obsolete in purpose; that said, a modernization strategy can facilitate a transformation that hugely boosts the capabilities of such businesses.

Getting started with insurance legacy system modernization

InsurTech and other disruptive technologies are already changing the market and customer expectations. As such, legacy system modernization is the obvious path to increase business value and improve customer experience.

Your monolithic legacy system and software have gotten you where you are today, but it’s now time to retire your old technology and step into the digital age. This is the time to consider where you could be right now if you’d modernized your legacy system years ago.

Keep that snapshot in mind and use it to motivate your executives and stakeholders. Assess your current system, seek team feedback, and start building a modernization plan today. With this done, your insurance legacy system transformation will soon be complete and delivering the sort of results you’ve only dreamed of.

We’d love to give you a demo.

Please leave us your details and we'll be in touch shortly