Learn all you need to know about mainframe to cloud migration: why you need it, the challenges you might face, and options for mainframe modernization.

The Future of Open Banking – and the Need for a Composable API Strategy

In an era of fast-changing consumer needs, how can banks continuously deliver the innovation that their markets demand?

Open banking provides third-party financial service companies access to consumer banking, transaction, and other data from financial institutions through the use of APIs. Open banking fits into a larger cross-industry movement to build open APIs so third-party service providers can access data.

Open banking promises numerous benefits to all players in the banking ecosystem:

Open banking promises numerous benefits to all players in the banking ecosystem:

- Enabling banks to expand their product offerings and distribution channels through partnerships with fintechs

- Providing an improved customer experience

- Evening the playing field for all vendors

But the promise of open banking can be hard to capture in practice, especially for banks that rely heavily on monolithic core systems.

Why open banking matters more than ever

The stakes could not be higher for banks to provide consumers with self-serve digital access to financial products and services. Even prior to COVID, research suggested that only 20% of consumers prefer to visit a bank rather than conduct their business using digital channels.

Yet because of legacy technology workflows, financial institutions frequently force consumers into brick and mortar buildings for account creation or other complex transactions. These requirements hurt their new customer acquisition.

Case in point: one challenge that open banking hopes to solve is the use of screen-scraping, where fintech access banking data on behalf of customers by using their banking credentials.

Embracing open banking is not optional for financial institutions. Application leaders who adopt a strategy to block aggregators risk alienating their own customers. These institutions need the innovation that Fintech companies bring to tdigital account creation, onboarding, and retention.

Open banking represents the best opportunity for many financial institutions to rapidly accelerate their digital transformation through an infusion of Fintech innovation. Open banking platforms like BIAN focus specifically on helping financial institutions build composable enterprises (here’s a video that explains how).

Keeping pace with regional open banking requirements

Beyond the business benefits, there’s another reason for banks to prepare for open banking: legal requirements. Individual countries and regions are progressively adopting regulatory frameworks laying out what and how data must be shared.

Each country is developing its own plan for open banking. These vary in their timelines but share the goal of reshaping how large enterprise banks work with FinTechs – and how they all collaborate with customers.

To help leaders keep track of open banking requirements in their regions, we’ve prepared this EU and Asia open banking readiness cheat sheet.

What open banking requires

Fundamentally, APIs are the currency of the open banking ecosystem. They enable institutions to securely and seamlessly share data with one another, and form the building block of new product offerings and customer experiences.

But when it comes to generating APIs from monolithic core systems, not all approaches are equal. Most successful organizations have two key capabilities:

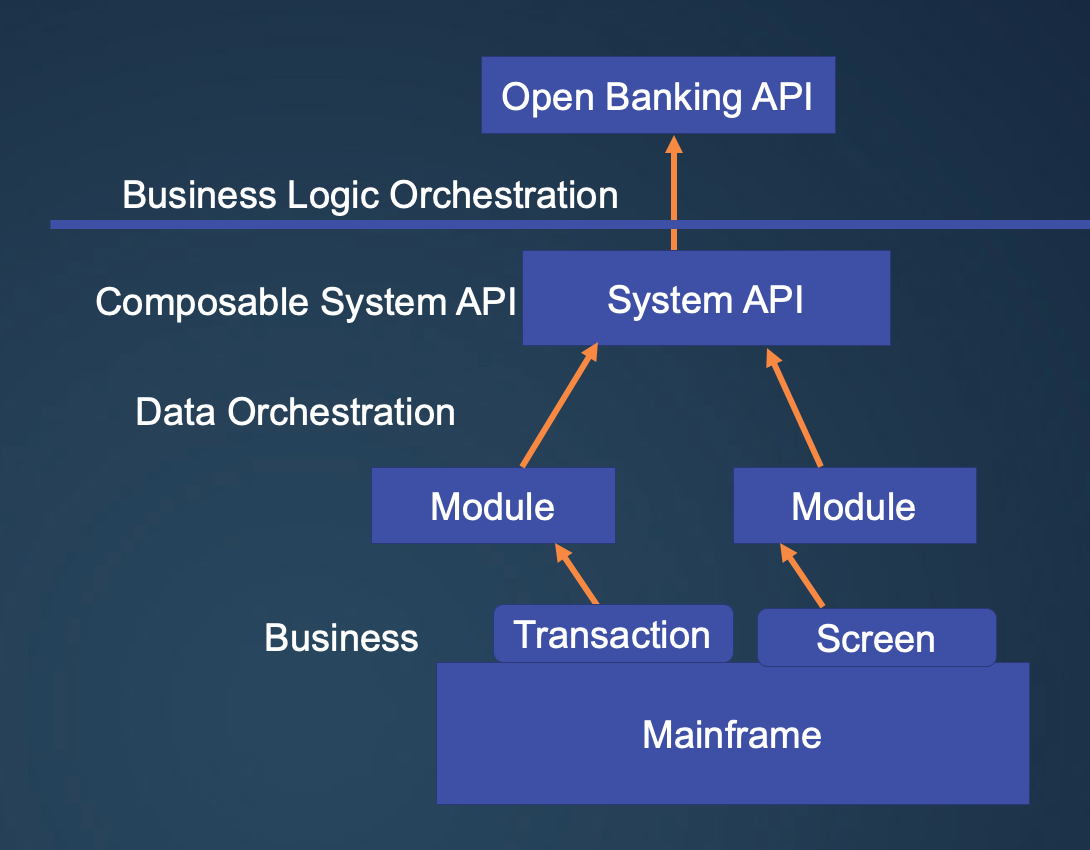

1.Composable system APIs (high-level APIs with business logic)

2.An API factory (the ability to rapidly assemble integrations into open APIs)

First: financial institutions that create composable system APIs have an easier time supporting the demands of the open banking API ecosystem. Composable APIs abstract higher level APIs from the core systems underneath. (See diagram below.) This makes the APIs easier to reuse across systems and also means if you change the underlying technology the higher level open APIs are abstracted from the issue itself.

OpenLegacy helps in this regard by building modules inside microservice-based APIs. The modules contain the logic that connects to the mainframe and does the data conversion.

The system API then is connected to your middleware or directly to the Open Banking APIs. This gives a streamlined approach to the development and run-time process.

Second: a whole group of integrations need creation to support open APIs. An API factory approach is critical for success for staying on time and on budget. Building an API factory requires a combination of technology, practices, and organizational mindset. You can read more in this whitepaper on how to do it in practice.

The bottom line

Open banking represents the next great revolution for financial institutions. It offers the potential to nurture a vibrant Fintech ecosystem, create new sources of value for consumers, and strengthen the traditional banking sector. Beyond that, open banking is increasingly becoming the norm from a regulatory standpoint.

But it can be difficult to support open banking in practice since it requires both the ability to create composable system APIs along with an API factory mindset: frequent stumbling blocks for banks with legacy technology.

OpenLegacy helps global financial institutions prepare for the future of open banking by delivering the building blocks for composable system-level APIs and supporting a fully-automated API factory. You can learn more about our approach here.

We’d love to give you a demo.

Please leave us your details and we'll be in touch shortly