Learn all you need to know about mainframe to cloud migration: why you need it, the challenges you might face, and options for mainframe modernization.

Legacy Banking Systems: Why and How to Modernize

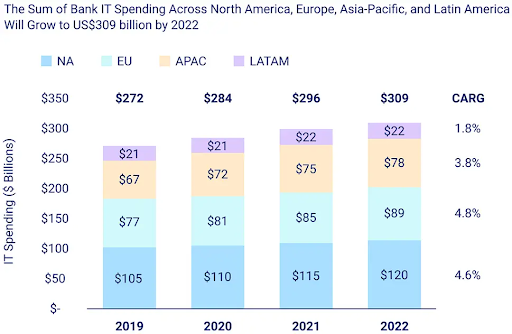

In 2023, modernization and digitization of legacy banking systems is to be expected. This drive for transformation is occurring at a rapid pace compared to other sectors, with 18% of banks planning to develop a digital strategy this year, and is particularly directed at any sort of legacy core banking systems.

These older types of banking systems can cause many challenges, but providers of banking services have a number of options at their disposal when looking to modernize.

Cloud computing is one of the most popular of these options. Understanding banking cloud architecture and its benefits can help you answer important questions, such as how adopting cloud core banking will affect your work processes and the services you provide to customers, how ready you are to modernize legacy banking systems, and whether there are any caveats that you need to consider.

What is legacy banking?

There are many traditional banking institutions that rely on legacy core banking systems. Developed years, or even decades ago, these systems often consist of monolithic, complex, and rigid architectures that were designed for specific banking functions. Legacy systems typically rely on older programming languages, databases, and hardware and are known for lacking flexibility and scalability. They can also be challenging to maintain and incompatible with more modern banking systems.

However, core banking, which covers the indispensable financial services of payments, loans, and mortgages, is normally part of an institution’s legacy systems. This means that, despite high maintenance costs along with limited capabilities and efficiencies, there is a significant risk to modernizing legacy systems.

Nonetheless, the financial industry continues to undergo digital transformation, and traditional banking institutions need to modernize legacy banking systems to stay competitive.

The challenges of using a legacy financial system

As technology continuously evolves, legacy financial systems used by traditional banks are becoming increasingly outdated. Larger organizations will struggle to compete if they don’t make the move to cloud banking along with their competitors.

Aside from remaining competitive, there are an increasing number of disadvantages to continuing to use a legacy system:

Restricted data integration and reporting

Legacy banking systems are often restricted when it comes to reporting. The amount of data that you need to collect and utilize will only continue to increase, and legacy systems limit the accuracy and scope of the reports you can gain from this. The lack of real-time data and analytic capabilities of legacy systems prevents decision-making based on up-to-date insights. Furthermore, traditional legacy systems can make it difficult to integrate vast amounts of data from various systems.

Security Vulnerabilities

Outdated security protocols, poor data encryption practices, or lack of support for modern security measures can leave legacy systems with significant security vulnerabilities. Financial institutions and the sensitive customer information held by banks are obvious targets for cybercriminals. A lack of up-to-date security controls can lead to data breaches, which would be costly for you both in terms of money and reputation.

Manual processes

After decades of optimization some of the oldest legacy banking systems can be highly automated, however, they’re still not designed to work well with other digital channels. This means undertaking manual work and spending longer on what should be simple tasks.

High Maintenance Costs

The older code that legacy systems use means that maintaining and supporting them can require specialized skills and resources. As these systems age, finding the correctly qualified personnel will become increasingly difficult and expensive, leading to higher operational costs. Security patches and updates for software compatibility will also increase costs.

Limited flexibility

Legacy systems often lack flexibility, making it difficult for you to add new features and functionalities to meet changing business needs. The intricate and monolithic architecture of these older systems means that even minor changes can be time-consuming, costly, and complex to implement. One example of this is that legacy banking systems may not be able to provide the web and mobile banking access that customers are starting to expect. This lack of flexibility limits functionality and prevents you from providing competitive customer service.

Remote access

With more and more people working remotely or on a hybrid model, accessing the information and data needed to do their jobs from a legacy system can be next to impossible. This can also create even more security issues.

Scalability Constraints

Legacy systems have architecture and infrastructure that were designed with older computing capacities in mind. They may struggle to handle the increased transaction volumes needed to meet the demands of a rapidly expanding customer base. This means that they will also struggle to accommodate business growth.

Update to a modern banking system in the cloud

We’ve established that using a legacy banking system can cause significant problems for financial institutions. So, what is the solution? Cloud banking systems deliver banking services using secure servers that are accessed over the Internet. Your core platforms and apps can be run on these rather than using physical servers and networks, which are costlier to install and maintain.

Cloud APIs (application programming interfaces) make these systems easily accessible and represent one of the ways that legacy banking systems can be modernized.

Why opt for cloud banking platforms?

A number of benefits come from switching your legacy core banking systems to cloud banking platforms. The most obvious is it transfers the responsibility and cost of ownership for the physical infrastructure and often-complicated networks that connect your locations to cloud servers. This frees up your IT team to focus on other areas of your business.

With almost every sector making the move to cloud-based services, the longer you stick with banking legacy systems, the more chance your competitors have to get ahead. The rise of cloud-based services is demonstrated by the growth of SaaS (software as a service) as well as other changes in multiple industries, for example, virtual contact centers are now the norm rather than the exception.

The four primary benefits of cloud computing in financial services are:

- Better operational speed and capability. Your bank collects huge amounts of data every day. With cloud-based banking, this is more accessible. A cloud banking system can also greatly improve operations with better connectivity, more automation, and accurate, data-driven insights in real time.

- Strong security. It’s not just a case of good business practice to protect your customers’ data; you also have regulatory frameworks and laws to conform to. It’s important to ensure your data is secure within the cloud, maintaining security throughout the entire process of data being used on a variety of digital channels, rather than only having a secure data center. Furthermore, providers are constantly analyzing their networks and updating them to meet potential threats, which will provide more support for you.

- Better customer insights for improved customer satisfaction. Expansion of the financial services and fintech markets means there is more competition than ever before. Cloud banking platforms can provide you with more detailed customer insights, which will allow you to provide services that meet swiftly changing customer expectations.

- Significant cost savings on maintenance and middleware. The primary cost benefit of transferring responsibility for infrastructure to your cloud provider is that you’ll be able to reduce your physical IT infrastructure. You’ll also see a reduced outlay in terms of security, as your provider will constantly update and improve this at no extra cost, and maintenance of legacy systems.

Is cloud banking the only way to modernize a legacy system?

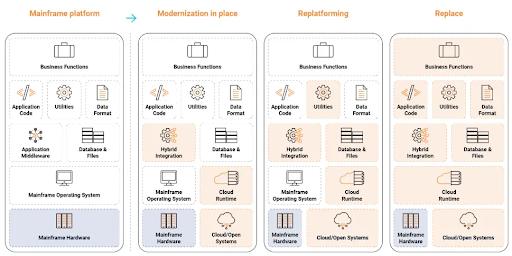

It’s important to point out that modernization is not a one-size-fits-all approach. While cloud banking may be the goal, not every business has the time or resources to immediately and completely implement it. Nor do they necessarily want to.

At OpenLegacy, our focus is on facilitating transitions that work for the individual enterprise. This means that whether you want to incrementally transition to the cloud or fully embrace its adoption, you can incorporate these methodologies into your on-premise core banking to modernize your systems and make them work for you both now and into the future.

To put it simply: you don’t have to fully transition to a cloud platform to reap the benefits of cloud banking. Instead scalable and flexible APIs that are driven by the needs of the user can bring you all the benefits of modern cloud banking systems.

What kind of opportunities do cloud banking services offer financial institutions?

Banks need to keep pace with the changing world around them, not just in terms of new technology and advances in fintech, but also in relation to rapidly changing customer expectations. People want their banking service provider to offer them instant digital access to their banking accounts, along with the ability to make online purchases and pay utility bills digitally.

Cloud banking services allow you to bring together all the data you collect and use as well as the various software and applications used by your customers or for your internal processes. By centralizing these applications with all this information, you can increase functionality and accessibility, allowing for quick and easy scalability.

Benefits of cloud adoption and computing in the financial services sector

On top of those that we have already addressed, there are more benefits that can be achieved with a move to the cloud. These include:

1. Flexibility

Cloud adoption in the financial services sector removes data storage challenges that you may have previously been contending with. Access is easier and faster, which means better regulatory reporting, improved analytics, better insights, advanced learning, and improved risk mitigation.

2. DevOps

With tech advancing so rapidly, cloud-based banking architecture allows you to develop new ideas and apps faster. It also means that you can reduce risk by ensuring compliance while creating new products. If you have a DevOps team, they will find it easier to achieve development, testing, and adjustments to existing technology.

3. Compliance

The banking sector has a considerable number of regulations and laws to comply with. These include the prevention of money laundering, privacy and disclosure, and fraud prevention. Banking cloud architecture makes regulatory compliance easier, as it can track and process data faster than legacy systems.

4. Technology

Advances in technology within the banking sector are not just about apps and software. As with other industries, you’ll have noticed an increase in AI (artificial intelligence) and ML (machine learning) for uses such as personalization. Integrating AI and Ml is simpler with cloud-based banking, which also offers you scalability when needed.

Modernize your legacy banking system with OpenLegacy

You should now understand why legacy banking systems are, in many cases, a thing of the past, as well as why it’s time to shift to the cloud and future-proof your business.

OpenLegacy’s Hub and legacy modernization solutions offer you the functionality and features needed to make this happen. These smart solutions bridge the gap between your legacy core systems and more streamlined cloud-based technologies to help you easily make the move.

This enables businesses to transform their mainframes from a restrictive cage into an open ecosystem, reducing outlay while reaping the benefits of cloud banking systems. Better protected data and a wider range of services will increase customer satisfaction, while key decision-makers will be pleased with the lower costs and the more informed decisions enabled by better data.

Examples of Legacy Banking System Cloud Modernization

As discussed in this guide, OpenLegacy Hub bridges the gap between on-prem legacy systems and cloud-based technologies. Here are two examples of modernization for cloud use that OpenLegacy completed.

The first example is a program initiated by Bank Leumi to transform them into an API-first organization by modernizing its systems. The program would allow the bank to comply with regulations, shorten time-to-market for new services, lower infrastructure costs, and support modern cloud technologies.

The process was ambitious. The key to its success was selecting Amazon EKS Anywhere as its cloud environment, Apigee as the API management platform, and OpenLegacy to provide mainframe connectivity that would expose the company’s legacy resources as microservices.

Bank Leumi was thrilled with the results, saying "Copybook to service in five mins"! Due to this success, Bank Leumi initiated a new phase of their program and set out a new challenge - to create 25 new microservices and deploy them to Production in one week - from Start to Finish.

The smooth integration gave Bank Leumi confidence in their API-first paradigm. They even opened their own Fintech service, called Finteka, to provide outside vendors with real APIs to use to connect with the bank.

The second example is a large multinational financial services company that operates a network of more than 1,200 branches and outlets across more than 70 countries. This company embarked on a digital journey to modernize its platforms keeping its mainframe at the heart. It was critical to leverage new cloud-native integration technologies to ensure that the company would stay relevant in this competitive space.

The long-term plan was to migrate away from their legacy mainframe. But first, they needed to add new straight-to-end-user banking functionality to what they already had. Additionally, they wanted this new functionality to handle bank transfers, and to continue to function as they progressed through their migration plan. The bank needed to build new customer services quickly but was working with outdated systems and languages (IMS and PL/1). Their core systems were also heavily reliant on multiple types of interfaces, including synchronous, asynchronous, and bulk. This challenging arrangement made it difficult for any single vendor to support them. Furthermore, although they had invested in an ESB years ago, the process was slow and expensive. They still had 98 new features to implement and also wanted to develop modern digital systems that leveraged their current legacy information.

The OpenLegacy platform supports PL/1 and IMS out of the box. It also supports an expansive range of integration types. This flexibility allowed the bank to automatically generate the microservices-based solutions they needed.

However, the bank transfer process presented some additional complexity. Transfers into their system used synchronous calls, while transfers to other banks used asynchronous calls. The OpenLegacy platform includes the ability to build APIs to work in compliance with these intricate bulk processing rules. The solution also allowed the bank to build an API Factory using a DevOps pipeline, which included mainframe integration assets. They built the new services using a cloud-first development and delivery architecture.

FAQs about modernizing legacy banking systems

What is cloud banking?

Cloud banking involves storing all your data and apps in servers that are accessible via the Internet, rather than using traditional, location-based infrastructure, which can be unwieldy and inefficient.

Why are banks moving to the cloud?

Banks are choosing to move to the cloud for several reasons that make good business sense. Some of the benefits of cloud-based banking systems are reduced costs, increased security, more efficient business processes, and reduced IT complexity. It can also improve compliance, scalability, agility, and data analytics.

Which cloud model is best suited for banks?

Private clouds are a necessity given the amount of data being handled and its sensitive nature.

These can be managed by the bank itself or a reliable third party via an open banking model. In many cases, banks will use a third-party cloud-native provider.

Is cloud banking secure?

There are some concerns about the security of cloud banking. These include data privacy, potential risks of unauthorized access, data breaches, and dependence on third-party providers. However, strong security measures, such as encryption, physical security, redundancy, compliance, access controls, and monitoring, can mitigate these concerns. Cloud service providers invest significantly in securing data and infrastructure and financial institutions should carefully select a reputable and trustworthy provider that can provide a secure, modern cloud banking system.

We’d love to give you a demo.

Please leave us your details and we'll be in touch shortly